MARKET UPDATE

Phil Edmonds, Apiculture New Zealand

Eyes are on the USA trade policy settings as honey exporters look to anticipate demand in the year ahead.

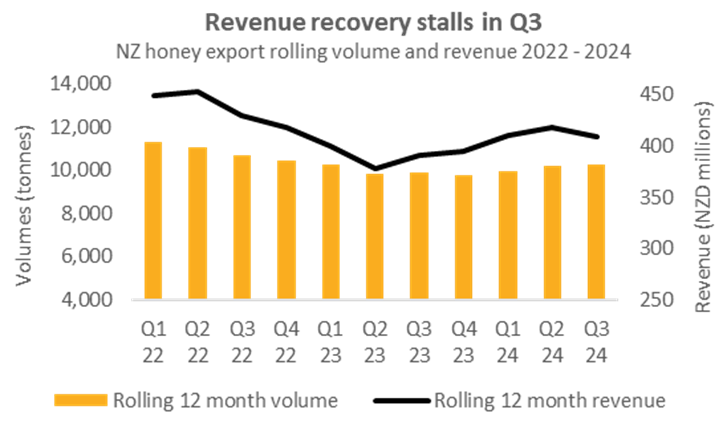

New Zealand honey exports for 2024 will likely match 2023 shipments, but the year ahead is less certain.

The honey trade data for the third calendar quarter of 2024 did not deliver any surprises. The trends that have emerged over the year to date broadly continued—that is, more modest volumes of honey being shipped to China than in previous years, the USA becoming more important to the sector’s export revenue fortunes with a growing share of the total trade, and average prices still lower than COVID-era levels in most markets.

The total volume of honey exported from New Zealand in the nine months to October 2024 was up 6% on the same period in 2023. Revenue advanced by a slightly lower percentage, with prices down a fraction ($39.05/kg, from $39.50/kg last year).

Within that overall stable picture, China has been less so. Prices have weakened considerably in 2024 (particularly in the first quarter), while the volume of honey shipped to China was down in the middle (April–September) months by 21% compared with 2023. This curtailed demand had been expected after large volumes of honey sent to China ahead of key selling dates in late 2023 did not find as many consumers as hoped. That excess inventory in China took some time to sell down, and the data suggests that it has been done so at the expense of margins. While volumes are still trailing in China, export prices have recently firmed, which provides some encouragement that existing consumers convinced by the quality of New Zealand honey are still ready to pay a premium for it.

The USA has been a more rewarding market for exporters. Volume for the 12 months to October 2024 was up 29%—a reflection of mānuka honey further expanding its penetration and exporters making connections with new consumers. Importantly, prices for the highest value New Zealand honey exports have largely remained the same. This suggests an increase in competition within the USA market has not been significantly dented by discounting or forsaken margins. Furthermore, the volume of monofloral mānuka honey shipped to the USA has been consistent in all of the past four quarters, indicating there has not been any noteworthy oversupply. There have, however, been recent signs of stronger demand for a cheaper mānuka product; 188 tonnes of retail-ready multifloral mānuka honey was shipped to the USA in the third quarter of 2024, compared with 79 tonnes in the same period in 2023. This latest finding has contributed to the overall growth in sales of NZ honey in the USA.

While honey exports in 2024 were largely foreseeable, there is considerably more uncertainty about the fortunes of New Zealand’s export trade in the coming year—especially following the USA election.

Much attention has been placed on President-Elect Trump’s repeated talk of imposing a 10% to 20% universal tariff on all imports. If this is implemented, it would make New Zealand honey more expensive to USA consumers at a time when higher inflation and slower domestic product growth would be a likely effect of a revised economic policy. That inflation would likely see USA consumers seek value in their spending, with a new emphasis on private label products. For New Zealand honey exporters, this might cement more interest in lower value mānuka options.

Tariffs on USA products will inevitably have a spillover effect on the spending power of other markets that currently have significant trading arrangements with the USA. China and Japan are two countries whose economies could suffer to an extent that reduced spending power will lower demand for New Zealand products.